Trend reversal is the most anticipated event in the world of Forex traders. Each of them wants the first “to enter in a luxury car” trains “Big Profit” and not to jump up on the step of the last platform. So the question is how to determine trend reversal has never been and will not be for the trader the rhetorical

The many reversal patterns, including candlestick patterns trend reversal, very often give conflicting signals, most of which, moreover, it is false. To accurately and timely predict trend reversals no indicators (and them too) it is, in principle, not easy, but with the right approach gives the trader high returns.

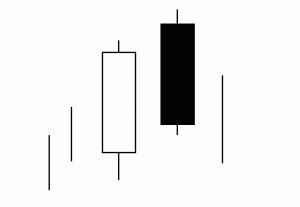

Next, you will be considered one of the most reliable, if not the most reliable reversal pattern candles, which received poetic, like many other Japanese candlestick patterns, name the Veil of dark clouds.

The formation of the pattern and its appearance

Reversal patterns candlestick is always neat but rarely self-sufficient. In this respect, the dark cloud stands out from its counterparts, although its signals cannot be considered the ultimate truth.

This pattern, like many other candlestick reversal patterns, visual and easily recognizable. But to avoid becoming a victim of illusion you should check the following parameters of formation of this figure:

- Both candles should be long, full-bodied and with short shadows on both sides (or no shadows);

- The opening price of the second (dark) candles must be above the closing price of the first candle. On short time frames (H1 and below) they can be equal;

- The dark candle should close at a price higher than the opening price of light, besides, the closing level of the second candle should be placed below the middle of the body light the candles.

Under these conditions it is safe to say that the chart has made a Veil of dark clouds with all its consequences, which will be discussed further.

But first need to briefly consider the psychological bases for the formation of this pattern because of the shape of a trend reversal reflects not only the economic situation on the market.

Pattern Curtain dark clouds are often formed after the release of important economic news. Especially if the news was “God knows what”, i.e. did not meet traders ‘ expectations. Still, most often, this figure is crowned by a continuous and dynamic trend, and reports that the bulls are losing faith in this instrument. It is this mistrust is a powerful Foundation for the formation of a new bearish trend.

Trading strategy on the model of a trend reversal

Almost all candle patterns are widely used by apologists of trading technologies, or indicator-free Price Action trading. Of course, this technology is not flawless, but the beginning of a new trend, often when observing the Veil of dark clouds – there is no alternative.

Yes, there are many technical indicators, which allows high accuracy to determine the power of the pulse, but their time will come later, but at the stage of making decision on entering the market the trader should be guided solely by the tools of graphical analysis.

In reaching a decision it is necessary to pay attention to the presence (or absence) of additional signals. For example,

- The greater the length of the dark spark (i.e. the greater part of the light of the candles it absorbs), the higher the reliability of the signal. In addition, a large length of the rotating spark allows you to make preliminary assumptions about the momentum the emerging trend;

- The lack of shadows on both candles is also a favourable sign. Pattern with candles without shadow was called “Black day” and is a very powerful sell signal.

You should also pay attention to the trading volume for the selected trading instrument. If the formation of a dark candle was accompanied by growth, it significantly enhances the pattern.

The proximity of the strong resistance level is also a powerful confirmation of the seriousness of the “bear beginnings”.

Shown in the figure the situation is so close to perfect that there are doubts about its authenticity. But it very clearly demonstrates the presence of these “amplifiers” and the end result of their “efforts”.