What is a technical analysis for binary options? If briefly – that is the basis of all the basics of binary trading. Analysis of binary options has long been in the service of punters around the world, helping them to determine the direction of the price movement of an asset and to profit from stock exchange transactions.

A bit about binary options

The concept of “option” came a long time ago, but in everyday life they came relatively recently – in 1973. Then by Chicago Board options exchange was first established rules governing the trade of these handy contracts.

In General there is a option? Is it right to sell/buy the asset at the agreed time at the market price. This is a quick concept of a classical option, but now we are talking about binary options. What’s the difference?

The fact that the trader is not obliged to buy/sell a classic option at this time – he can only take advantage of this opportunity. A binary option involves an obligation to purchase/sell. So, at a specified time the option is closed with profit or loss for the trader.

How is this determined? The rule is simple: if a player purchased a call option on a (bet, that the price for it by the end of his life will be higher) and the price at the close really was above – he receives a specified profit. If the price was lower – he loses all the money invested in the option. And Vice versa.

How to guess: the price will rise or fall? The price is displayed as a live graph on the special trade platform. Studying the laws of motion of this graph is possible to predict the long neck of the price behavior. This is a different approach and one of them is called technical analysis. It is done through special programs indicators based on specific algorithms that predict the future behavior of prices.

Thus, for correct operation on the exchange, each trader must be able to conduct technical analysis. Binary options is a relatively uncomplicated tool to raise earnings, however, it also requires some basic knowledge and skills. And the higher the level of such knowledge, the greater heights to reach. Only by learning to identify patterns of price movement on the chart you will be able to earn with binary options.

Basic principles of technical analysis

Such principles are only three:

- In the chart based on all the factors that can affect the price.

- Price movements always occurs in the direction of the trend.

- The price history is cyclic.

Best online trading on the stock exchange binary options to implement, based on a combination of different methods of trade. There is no need to immediately become the guru of the market, and of the possibility of such either.

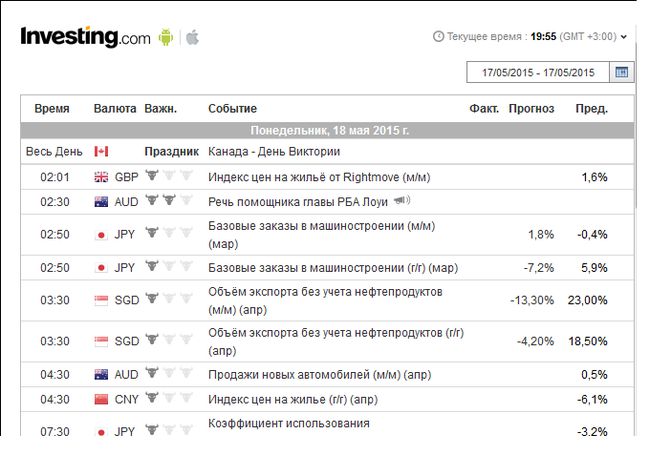

Important! The trader must to know what the most important news from the sphere of macroeconomics came out today.

To do this, refer to the macroeconomic online calendar:

Trend price movements is the basis of online technical analysis and basic principle of working for many trading methodologies.

Trend price movements

The trends in the graphs are divided into three types:

- Short-term trends.

- Medium-term trends.

- Long-term trends.

To determine the duration of the trend on the chart you will need to use higher timeframe. In binary options trading, unlike securities, are considered one-day trends. So:

- A long-term trend is a trader on a day chart;

- The medium-term trend detected at 1-4 time quotes;

- Short term trend looking at 5 and 15 minute intervals.

In determining all types of the trend on the same graph, it is clear that the long-term trend consists of many mini-trends of a shorter duration.

The cyclical nature of price movement on the chart the basis of online technical analysis implemented on a candlestick, and reversal patterns:

Such an option technical analysis can be applied to virtually all types of trading assets the exchange — such as:

- Pairs of currencies (EUR/USD);

- Securities (AAPL);

- Stock indexes (S&P 500);

- Futures (CL);

- Raw assets (UKOIL).

A few words about the fundamental analysis

When conducting technical analysis focus on direction of price movements, their frequency and amplitude, the pulse nature of the changes on the chart, candle formation and other factors.

Adepts also prefer the fundamental theory in the analysis based on economic factors. It has a turnover of funds, the loss ratios and profitability, and so on.

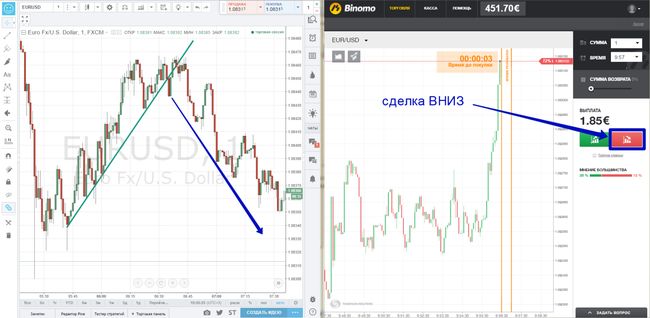

When conducting technical analysis in binary options trading traders also use elements of fundamental analysis, using trading strategies news from the sphere of macroeconomics.

What is the price corridors?

Price band (price channel) is an essential graphic structure in trading binary options. Price usually moves on the chart within the trend. Its movement is downward, upward or horizontal (flat). This property quotations based a number of highly profitable indicator trading strategies.

Important! In any case it is impossible to trade against the trend!

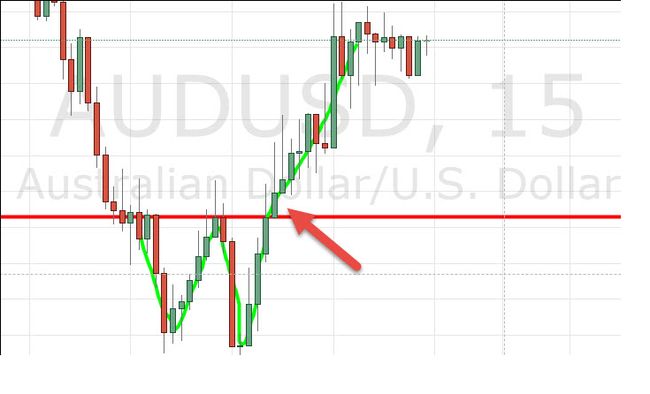

Levels of support and resistance

The so-called conventional boundaries, which occurred rebound rates.

The support line does not allow the price to fall, as if keeping it at a certain level. Underneath.

The line of resistance is “resistance” to increase prices. Passes through from the top.

When on the chart a break out occurs one of the lines brokers of an asset, this means that the overall market trend has changed and expect a speedy formation of a new resistance levels and support:

On the basis of the phenomena occurring on the chart in the data link properties quotes, based a number of highly profitable trading strategies for binary options.

Tip!When important macroeconomic news on the charts are formed by a pulsed movement with such force that the breakdown of the levels becomes almost inevitable. So do not ignore the news calendar – you need to be alert.

Briefly about the volumes and shapes

Cluster analysis (volumetric analysis), being the relevant futures exchanges, is not as popular on the stock exchange binary options.However, in binary trading, is involved in the phenomenon of divergence when the trend is directed, for example, up despite the decline.

The types of display quotes

In technical analysis binary exchange most often involves two types of display of the price chart:

- Candlestick (the Japanese candles);

- Linear.

Quotes displayed in the form of so-called Japanese candlesticks, by themselves, can say, they are indicators. There are several hundreds of combinations generated quotation candles. It may become the basis for a highly informative analysis. Not necessarily to remember everything is enough to choose some models and learn to work with them under different conditions.

Linear quotes – the simplest form of displaying price on the live chart, used mainly for high-speed detection of a trend.

Graphic shapes

This combination generated on the chart its various components. Often they are detected when using a subsidiary trading tools and graphical services. Such combinations are cyclical and reflect the real situation occurring on the exchange of the asset.

The use of figures in the binary options trading greatly improves the performance of the stock player.

These are the basic graphical shapes that every trader needs to know working with binary options.

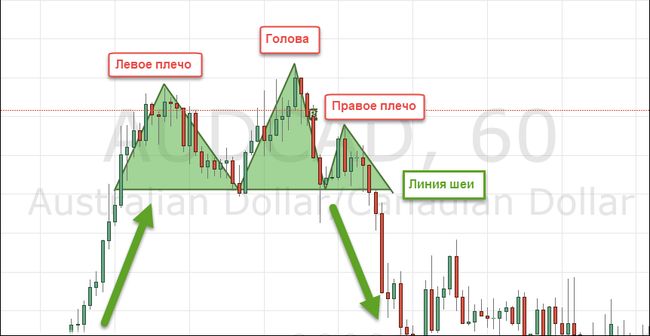

Head and shoulders

Is the most popular figure of the technical analysis with a long history.

The head of the figure is the maximum extremum of price values on the chart and the shoulders two intermediate price peak.

Head will always rise above the shoulders that can be placed at different levels. The screenshot below shows how the set “the neck line”. When the quotes beyond can signal a reversal of the old trend.

Head & Shoulders is a supporting graphical tool to apply this pattern when working on quotations (see screen):

Cup

The graph has the approximate shape of a Cup with handle. Frequently occurs, the accuracy of the contours is not required. Depicted on the trend rules.

Double top normal

Also indicates a reversal of trend. Traders believe this figure is a very reliable signal. Occurs on the chart after just two attempts breakdown quotes one of the lines (resistance or support).

Double top inverted

Triangle

Refers to the basic figures of technical analysis that exist on the exchange over the centuries. Is divided into three types: symmetrical, ascending and descending.

In fact, the triangle formed by the trend lines. For symmetric varieties two trend hand equipotential connect at one point.

The remaining two species, one of the sides is horizontal and serves as a line of support or resistance.

Examples:

Flag

Meet at the charts very often and consist of the price channel, located under the slope and “handle”:

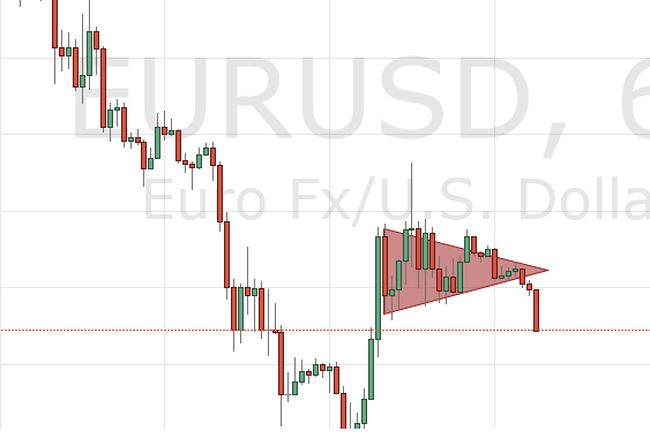

Pennant

Is a figure, like a triangle, with the same “handle” formed by the candlestick quotes, as in the previous figures. In the screenshot below you can see how there was a breakthrough figure “Vympel” in the direction of the trend:

Wedge

Looks like a triangle, elongated horizontally, with the apex directed into the upper or lower side. Can either confirm or refute the existing direction of trend movement on the chart.

The output of the quotations on the chart the top side of the triangle says about the confirmed trend, and when that go beyond their lower side – about the formation of its reversal.

Important! Effective on higher timeframes.

Figure the Bottom (Triple top)

Also refers to the figures of the reversal type. Has three pronounced the lower portion of the rebound of quotations of the asset from the support line.

After the incident three times the bounce on the chart as a reversal of the trend movement.

Saucer

As a rule, testifies to the emergence of a new long-term trend. And best of all a price reversal using of this figure is revealed on the time frames of 60 minutes or more.

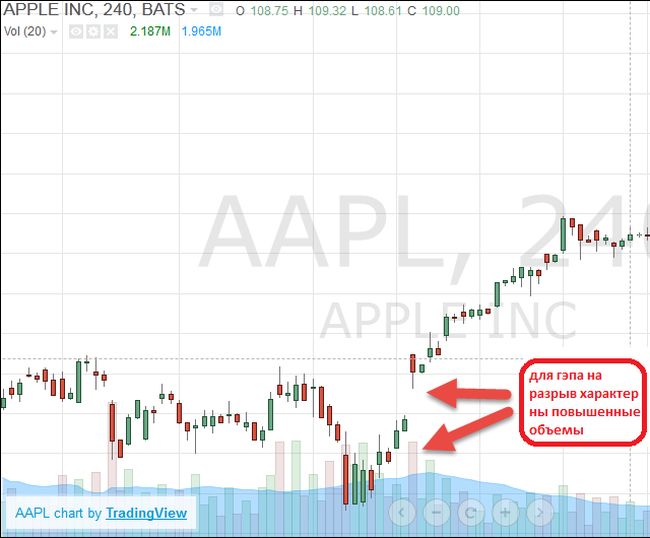

Gap

Geo – it’s not even a figure, and nothing filled the space between the quotation candles. It occurs in moments of calm between periods of active trading, including the weekend.

But sometimes it appears on the chart due to excessive difference in prices between different trading periods (this is important mainly for the securities market).

In addition, gaps occur on the charts and in moments of pronounced “jumps” in the asset price.

There are three types of gaps:

- Gaps “into the gap” (with increased volume);

- Gaps “in the wild” (with a pronounced trend movement);

- Gaps “on the decline” (for a short period before the emergence of fresh trends in the chart).

Maintain knowledge gaps – is a separate subsection of the technical analysis and is used mostly on stock exchanges and Forex. Binary market punters rarely use them.

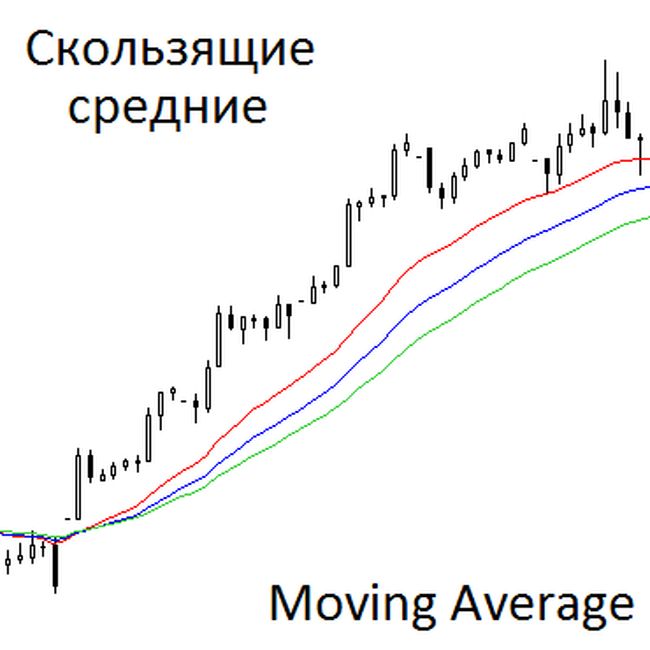

Moving averages

It is a graphical tool that displays the average value of an asset over a certain time period. By applying this tool to more accurately and easily identify a trend, the emergence of fresh trends and the aforementioned support levels and resistance.

Moving averages are divided into the following types:

- Moving Average;

- Weighted Moving Average;

- Simple Moving Average;

- Exponential Moving Average.

This option is the simplest indicator is present in the embedded set of practically each terminal binary exchange.

Other indicators

Every trading indicator performs mainly two tasks:

- Confirms the direction of the trend movement;

- Confirms the figure or model of the reversal of the movement.

Examples:

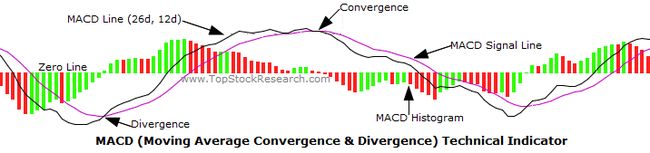

Tool MACD most often used at the intersections, using the power of the Moving Average.

Tool RSI

Tool RSI is used to determine strength of trend to identify areas of overbought/oversold on the charts.

Tool Is Stochastic. Determines the strength of price movement. If in case of pronounced trend quotes tend to the upper limit, soon to be followed by reversal. Therefore, when using the stochastics should pay attention to areas of overbought/oversold.

Highlights

Are you following all this?

- The price history is cyclical, the quotes are almost all the information on the asset market and they make driving the trend;

- The technical analysis will be more effective in the presence in it of elements of fundamental analysis;

- Quotes can move not only on trend, but flat;

- Trade with the trend is the most simple method, based on elementary analysis;

- The price corridor is an important graphical support tool;

- There are two main types of displayed quotations for work on the exchange binary options: candlestick and line;

- The figures on the chart are used to identify reversal of quotes;

- Moving average works for trend detection and extinguishes the so-called stock noise;

- Work ehindicators is based on a mathematical formula, which takes into account price movements on the chart of price and volume.

Tip! Should not be abused by adding at the charts of a large number of signaling tools. Because indicators can not predict what is happening in the market asset, as a simple mathematical formula.

To achieve high shopping results should wisely use in the auction a full Arsenal of auxiliary analytical devices: from news, candlestick charts and trend lines to trade indicators.

Reviews

Paul

14.06.2016

Thank you very much to those who correctly explains the fundamentals of technical analysis! I’m about a week just traded binarni and wanted immediately earn more. Very well, that is not seduced by advertising avtorobotov! I watched the video on technical analysis and realized that really I was lucky I didn’t fail!)))

Princess

11.07.2016

Here it is what it is. It turns out that candlestick strategy based on the cycles? But why is there a recurrence? This is somehow also connected probably in binary the demand-offer? So I would like clarification on the PPR models and BEOVB. Why bidders are cyclical over and over again making duplicates?

Vladislav S.

19.07.2016

Said it right, cyclicity is present. And the principle of “this has been and will happen again.” I advise you to read about the psychology of the pattern, soon all will become clear.

Mitya

21.08.2016

Traded about two years with varying degrees of success in the plus, minus. Well General plus came out, but on a very modest amount. And finally with the help of normal independent technical analysis candlestick chart I entered in the process! Trade corridors exist, income can only be happy.

Vitaly Petrov

29.08.2016

Why own schedule at the terminal of the brokerage company can be called invalid? If the result of the trade is recorded at the closing of the transactions on this chart?

Igor Fibo

30.08.2016

Such graphics can be pretty low quality because of poor programmers. To make the technical analysis you need a quote history. If it is false, then the analysis will be unreliable. Can anything happen. Not worth it on such a technical analysis to rely on. The more You’ve been warned.

Karaganda

11.09.2016

Everything is clear with the analysis for me in addition to lines PODDERZHKI and resistance. Now, if the trend is sloping, not flat – they will also be inclined? Or what? Or they should be conditional to hold still horizontal, then?

Alexei Sivakov

24.09.2016

You have to understand that horizontal lines in contrast to the much more informative channel! The channel is very often converted into graphic shapes with a sharp change in volatility.

Karaganda

29.09.2016

Oh, now thank you, of course! And not found about this anywhere.

Lopatin

02.10.2016

Faced with a situation where the indicators on the chart in fact less than the forecast. That is, there should be a bearish engulfing. But the quotes I see the appreciation of the dollar against the Euro! How is this possible? Someone explain?

Lena

09.10.2016

It happens. “Bad” prognosis in a positive way to affect the asset, for example when a previously expected more of the bad forecast, but it came out not so bad) something Like that, I hope I clearly explain. That’s the positive news in the real world may be not so positive. In addition, the forecast is not exact values, but approximate. If only it were so simple as you seem to represent, all the brokers would have gone bankrupt long ago. If you are new to the exchange, the better, I think, do not make light of the news, and gradually by the example of one most important news to try to study statistics, as it affects the exchange of an asset view, and stuff like that. You will succeed. You just do not yet feel market, but with time it will pass.