Pin bar – what is it? The so-called strong candlestick pattern, which is easy enough to recognize. But if the experience is not enough, it is very easy to make common mistakes: do not take into account the quality of its formation, location or wrong to enter a trade.

How to spot a pin bar correctly and to take advantage of the situation?

History

First trade pin bars mentioned by Martin Pring in his work “On price patterns”. But, the final popularity he gained after a certain James16 posts on a certain forum Forex Factory. Where he really expressed his thoughts and described developments. After, based on these posts, technique again and again cited the example of many practicing writers.

Description pin-bar

So what is a pin bar in trading and why is it so called? This is from Pinocchio, but is not the point. Model, much more serious than the eponymous character. What is the connection “pin bar Pinocchio”? For this you need to consider what it represents, then all will become clear.

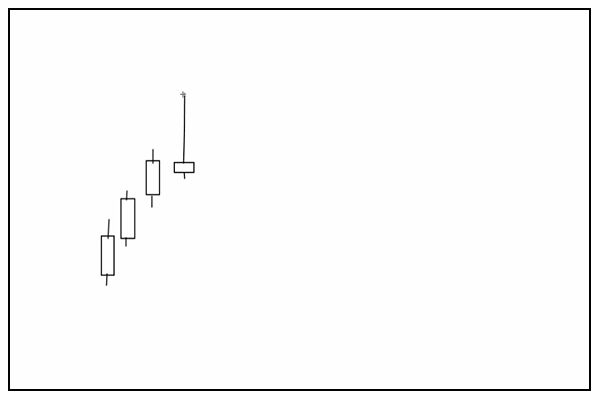

So, there is a schedule with a growing trend and it formed a candle with a small body. The body has two shadows – a very short and very long. Two candles on either side of the pin-bar his eyes. This is the candle called “pin bar”. A big shadow is associated with a long Pinocchio’s nose.

Important! Model (setup) is considered a reversal, but only if her body is within the body of the previous candle, but a long shadow is outside the neighboring candles. If the body is placed outside of this range is about pin bar. However, even if the body is out of place, but the shadow is not gone beyond the neighboring bars, then the model is simply considered an inside bar.

Why it appears? A certain time the price went up because traders bought this, but then something changed and the price went down. Bulls (buyers) start to lose, and prudent bears (sellers) are already actively selling, so managed to put pending orders for sale. Eventually formed a candle with a small body and a long tail.

In the end, it is obvious how the mood of the market has formed a well-known pin-bar. If this is it, the price will go down and will begin to form a bearish candle.

Trade on pin bar

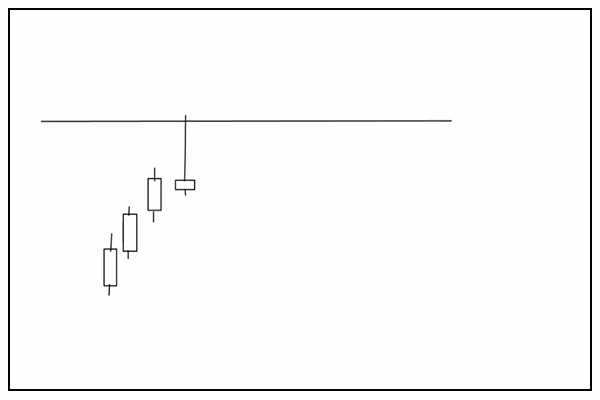

How to take advantage of this situation? First you need to be sure that the price will not go up (in the case of this example). Therefore, pre-exhibited a level of resistance above the pin bar. If this is not possible – it is better not to use it.

Attention! Trade occurs in the opposite direction from the direction of the “nose” of the candle. The color of the bar plays no role.

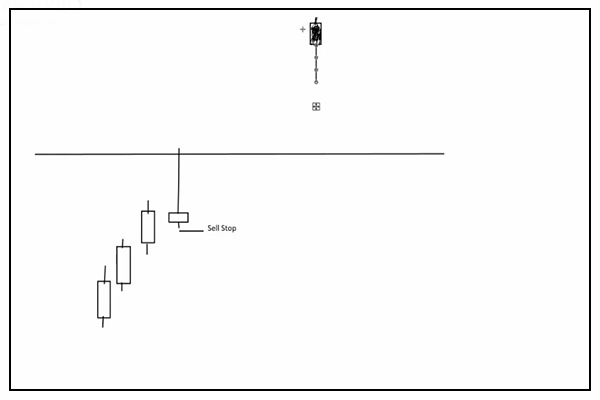

So, Forex trading strategy pin bar in the first place implies the classic version of the entry with a pending order Sell Stop below short shadows. But if after driving the price down, the model was drawn in the opposite direction, on the contrary, a pending Buy Stop order, already above short shadows.

Why is it done? If the price does not change direction, one of the orders does not work and it can be easy to remove.

There are other variants of actions in case of appearance of the pin bar.

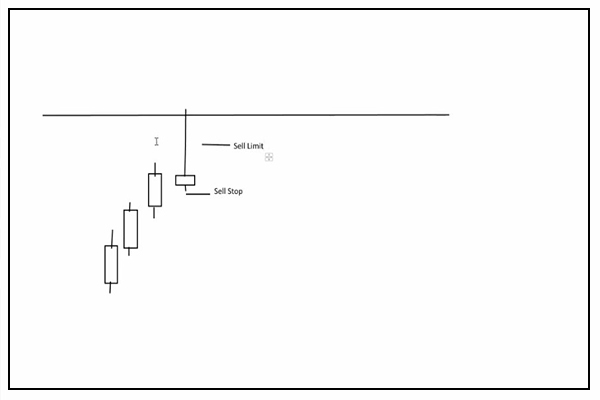

To enter set a limit order Sell Limit (in this example) approximately at the middle of the candle. Then you can get more profit, but the price may not fall back to the middle of the model and the income is not.

Sometimes it is correct to place the order just under the resistance level – you need to focus on the situation. Clear recommendations here. Therefore, beginners are better not to fool your head and use the first classical reception.

Even if the trader is sure of pin bar and reversal rates, you should not neglect the stop loss. You need to put it a little above the long shadow of a candle. Better yet, if stop loss will be above the resistance level. It is more reasonable.

Sometimes allowed a small stop loss, but only in case if the order is exhibited directly below the resistance – as in this example, a stop-loss is slightly higher, but outside of the level. Most preferred is a small stop-loss.

How to enter the market pin bar is clear, but when to close the deal? The right decision – to close the order at the next level of resistance, ie in the direction of the price. Not necessarily to sit and wait for this moment – you can set a Take Profit. Its size is usually equal to the size of the candle or you can take the stop loss size and multiply it by three, obtaining the size of Take Profit.

This is basic information to operate the pin-bar Forex. Other nuances become apparent in the process of working with him. Importantly, in these examples, is trading the pin bar with the trend, against the trend – this is a different strategy.

You can summarize and highlight some points:

- it is necessary to allocate only the finest pin-bars;

- the longer the nose, the better;

- only 10% of applicants are the most “correct” pin-bars.

Is there a way to automate the process?

Pin bar-binary options and the indicator pin bars BSU

Pin bar – universal model is suitable for Forex and for binary options. And, despite the fact that this setup applies to the strategy of Price Action where the indicators generally are not used, there is an option, including Forex indicator pin bars BSU – free download it here. This indicator pin bar for MT4 works fine on Forex and binary options. However, for binary will require several other modifications.

How does it work? It is clear that this setup needs to be shaped correctly and before you place the order or make a transaction with a call option, the trader is obliged to correctly identify. Many people don’t want to sit at the monitor waiting for the pin bar trading strategy.

Here for this and created a pin bar EA, which determines the correct pin bar and alerts to the trader, for example, by means of a special sound.

Conclusion

Which would not have traded trader on Forex or binary options, they must learn to accurately identify candlestick pattern a pin bar. And too short time frames(below H1), especially binary there are many false signals – it must be considered.

The indicator is, of course, good, but not excluded false positives. So you need to learn to read the graph yourself – it is not for nothing that the Price Action does not imply any additional software. The trader should get pleasure from analysing the graph, otherwise it is simply not worth it to trade.