“Three Indians” – the figure of a graphical analysis, first described by Linda Raschke, due to its ambiguity and complexity definition, is not a popular technical analysis tools.

Three Indian pattern, representing the culmination of a model losing a potential trend and, in fact, it is counter-trend figure. This wording clearly does not add to the pattern’s popularity, because every self-respecting trader in advance opposed to any of the trading strategies against the trend. This commandment is not negotiable, but at the same time I would like to note that trade against the trend, when correct analysis of the market and sophisticated money management that promises the trader a more substantial profit than trading with the trend when it comes to March in ranks and not in the forefront.

In light of the above we can confidently say that the Three Indians indicator, which can be downloaded in free access, deserves the attention of traders at least for the memories.

Three Indian languages: methods of detection

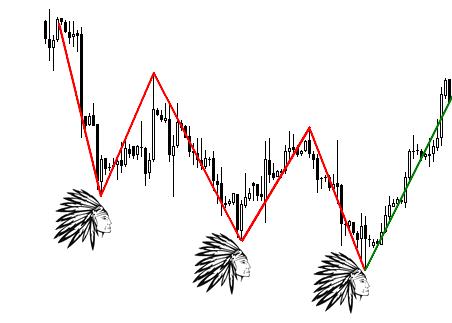

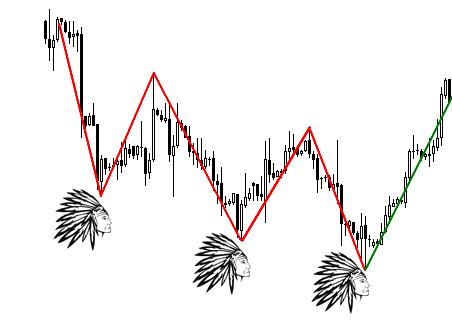

In appearance the figure of Three Indians, or as they called her Linda Raschke – Three little Indians, very similar to the classic ABCD. The main difference between these figures is that ABCD is formed by two waves, and the Indians three. If we consider these patterns as a mathematical model, we can say that Indians are additionally filtered ABCD.

In specialized publications and articles often can be found the description of the detection algorithm figure Three Indians almost from the first moments of its existence. We need to wait for forming the first wave, stretch the chain Fibonacci and quietly wait for the second wave. This option is well suited to “historians”, because in real time it is impossible to identify with certainty the first pulse. Before the advent of chart formed the second wave can not reliably determine is a burgeoning Three Indian or a random jump in prices or a correction.

And only after the chart displays the first two Indian possible to predict the emergence of another, i.e. to calculate the parameters of the third wave and, accordingly, to set a pending order.

For these purposes, Fibonacci levels – you need to stretch the mesh from points D to E.

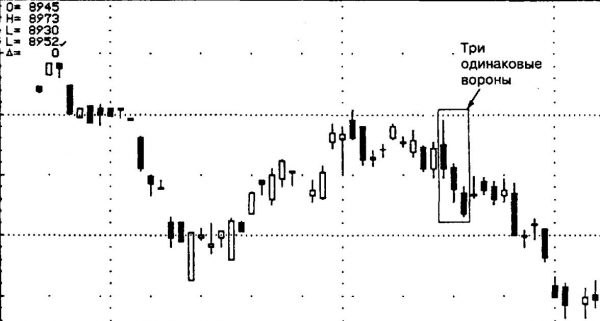

It’s a bear version of the figure that received the gloomy title “Three black crows”. Forex sometimes it shows the bullish version of “Three white soldiers”.

Features Three crows pattern on Forex

Given the picture the example of the figure “Three ravens” in that the precise execution found in reality is very rare. Because the figure is contrareloj and everyone knows how unpredictable the price of turning the trend. Therefore, to recognize the Indians always quite difficult. There is a direct correlation definition of this shape from the duration of the time interval. The larger the time frame is chosen, the clearer it will be drawn by the Indians. To apply the pattern for day trading is not recommended for reasons stated above.

There is a version of the Indians for intraday trading – it’s called “identical Three crows”.

The main difference of this pattern is a clear inheritance of candles, ie the opening price of next candle is equal to the closing price of the previous one. “The same crow” – very rare guests on the Forex market. All the Three Indians are harbingers of a trend reversal, which is necessarily accompanied by high volatility and frequent Gaps.

Strategy Three Indians includes a number of signals that enhance the figure. For example, if the first black candle (body) will be located below the maximum level of the last white candlestick, it is a good sign for sellers that informs about the seriousness of the “bear claims” and the great potential of the emerging trend. Accordingly, a favorable picture for the buyers will look exactly the opposite.

Figure Three indeitsev all options, and is self-sufficient, because with timely detection, its signals are unambiguous and understandable.