Trade the Price Action requires a careful analysis of the arrangement of the candles, their structure and combination with other bars. All models can be divided into 2 large groups – further confirming the price movement in the current trend and reversal patterns Forex. Among the models of a trend reversal Pattern Rails on the Forex is one of the classic.

It’s pretty easy to find on the chart of any asset and can be used as the basis for its trading strategies, as well as an additional signal.

The rails look like on the chart

The pattern of rails, the Forex market consists of only two candlesticks and can testify as to the change of bullish trend to bearish and Vice versa. In any case, it has the following characteristics:

- Two candles of different colors have large body and small shadows (often without shades).

- The closing price of one candle is almost identical with the opening price of the other (if it differs within a few points is not critical).

- In most cases, the size of the bodies of the candles are exactly the same – the graph shows that they are flush with each other, so they are called “rails Forex”.

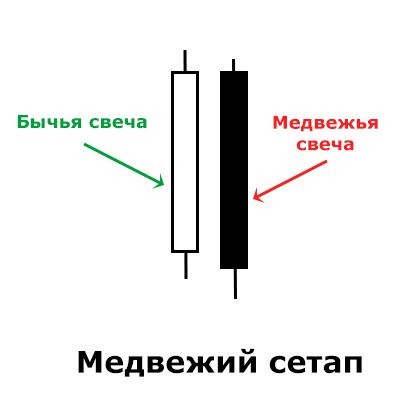

In the case when an uptrend changes to downtrend, talking about the bearish setup. It looks like this:

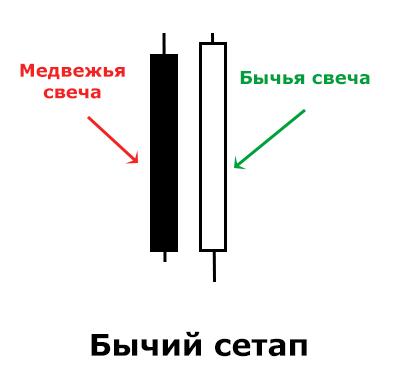

If on the contrary the descending stops and is expected to start for the growth rates, the pattern of rails on the Forex looks mirror:

That increases the chances of winning

Figures Price list Action, including the pattern of the rails, are often used in combination with other signs that can confirm the signal:

- If the market has already formed a clear trend, and the rails were formed immediately after the correction is a reliable entry signal in accordance with the direction (on the chart these situations are shown in figures 1 and 4).

- The rails are formed near important support level (in the case of the expectation of rising prices) or resistance (in expectation of falling prices), which have repeatedly been checked. So, in the chart of the stronger signal 5 signal 3, as in the first case, the price has tested the level as resistance.

- If the bodies of the candles are large and formed almost on a par with each other, and shadows are very minor or absent.

- If the rails are formed on higher timeframes (from H4).

How to use a pattern of rails in real trading

Subject to all conditions to enter the market what is a pending order. This is to ensure that it does not get activated if the price goes in the opposite direction. Thus it is necessary to take into account the following conditions:

- the order is fixed above or below (depending on trend) of the second candle, when it is already formed;

- stop loss you need to put a few points above or below the opposite end of the second candle;

- take profit it is best to put on a strong level of support or resistance, which is closest.

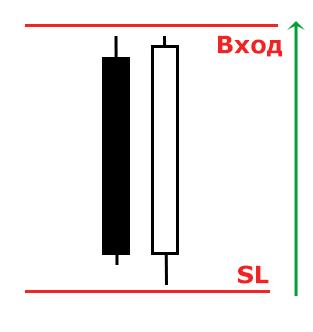

Example of placement of stop loss in case of a buy entry is shown below:

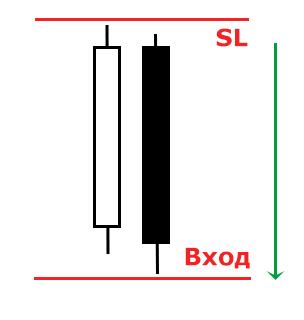

And this drawing illustrates the case for a sell entry:

When login is not necessary

Of course, none of the trading strategies do not work by itself, without considering other factors affecting the price movement. In the case of using the pattern of Rails should take into account those characteristics that weaken the effect of the signal:

- If the shadows of the candles are too big, and the body, on the contrary is small, the market is in limbo and the future forecast is more difficult to do.

- During the release of important economic news, as well as the first hours after the market they can choose the trend or seek to maintain the current of the previous trend, so the degree of uncertainty of future predictions increases.

- If bearish pattern setup Rails formed on the back of strong bullish trend and Vice versa – such a signal is unreliable (see example 2).

- If the pattern formed on the range market, which is still undecided with the current trend, such a signal is also better to ignore.

Conclusion

In General, we must note that the pattern of Rails Forex is secondary to the more powerful figures such as outside bar, pin bar and inside bar. However, it can be used as an additional confirmatory signal, especially in the presence of reinforcing features.