Price Action or indicator-free trade in recent years significantly expanded the circle of admirers. This trading system based on graphical analysis of price charts and completely ignores any indicators of technical and fundamental analysis. Different patterns Price Action allow with high degree of accuracy and efficiency to analyze the market situation.

The system is Price Action that might properly be called a family of trading systems, operates effectively in all markets regardless of the type of the trading instrument and the direction of movement of the price chart. As the technical analysis indicators, setups Price Action, able to timely signal the trends prevailing in the markets and possible changes of direction.

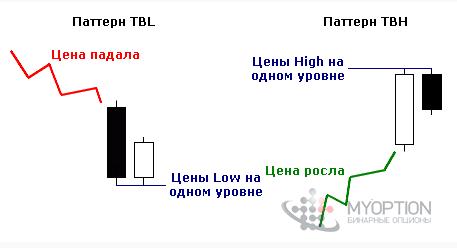

Price Action patterns are also divided into groups according to type of signals which they generate. The following will briefly discuss patterns of TVN and TBL, which perhaps represent the smallest group of patterns Price Action patterns market consolidation.

Patterns of TVN and TBL

In fairness it should be noted that the consolidation model essentially can’t be finite.

With equal probability for these figures can follow as a model turn in the trend and continuation patterns of the trend.

Both pattern quite easily determined on the graph. Criteria, for example, the pattern for the TBH, with the following:

- the formation of a model should be preceded by an uptrend;

- The first (light) the candle of the figure is directed, of course, up, and the second, resembling a bear correction should be much smaller than the first;

- The highs of the two candles must be at the same level (there may be several points of difference).

TBL pattern is formed in diametrically opposite conditions.

Strategy Price Action trading in TBH and TBL

There are several trading algorithms trade on the basis of the patterns of consolidation. Further, to be considered universal, if I may say so, the trading system. As mentioned earlier, after consolidation, there are two possible scenario is either a reversal of a trend or continuation of trend. TBH and TBL rarely bring long-lasting sideways movement of prices. Patterns of trend reversal less likely, but to completely discount them is impossible.

Trading algorithm, the present system is very simple. With a strong desire to draw an analogy with strategy Lazy trader. Its essence lies in the fact that simultaneously exhibited two divergent orders.

Schematically it looks as follows. Stop buy order is set to 5-10 pips above the high of the second candle. Sell order is set to 5-10 pips below the low of the same candle. Do not take the digits for a prerequisite. The distance from the extremum of candles for different trading instruments may differ. You should consider the volatility of the asset on which the transaction occurs.

For more tips on strategy

As with all figures without the indicator of trade, the question of fixation of profits and losses is the most difficult. Or rather a loss of it is clear – stop loss is set at the opposite end of the signal candle. Possible more careful options, but they can result in a loss of profit.

As for the take profit, here inevitably have to resort to using additional analytical tools to determine the potential trend.

As already mentioned, cases of the lateral movement after consolidation patterns are extremely rare, but nevertheless happen. The figure below shows just such a case:

Therefore it is necessary to warn traders too emotional. You should not attempt to make up the loss in that case, if both orders are closed by stop loss. If this trouble, the probability of which is extremely small, it has happened – it means that the market does not just move in anywhere, and is in a condition of strong lateral flat, the effect of which is almost impossible to calculate. In this case it is better to accept the loss or to switch to a different trading instrument.

You should learn to trade on a variety of patterns relating to strategies Price Action: