Forex analysis of the figures allows to define the objective evidence of the current trend and predict its shift to another. One of the most simple models of trend change pattern is an Island reversal on Forex.

To find a candlestick combination on the chart will be new, because visually it really looks like an island or a hill.

How to define a pattern on the chart

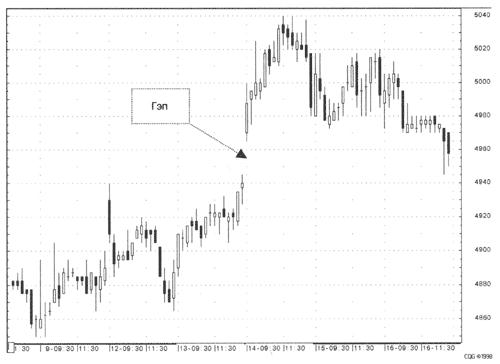

The peculiarity of this shape Forex is that it is formed on the market when price makes the gap large gap between two adjacent candlesticks. To see the geo chart is pretty easy:

Depending on the position in the trend there are three types of gap:

- Gap breakdown, which is formed in the beginning of a trend. After that the price usually moves a long time in the direction of the gap.

- Continue gap is formed in a trending market and predicts further development of existing trends.

- Gap depletion, which occurs in long-existing trend and predicts his imminent reversal. All three schemes are shown in the figure.

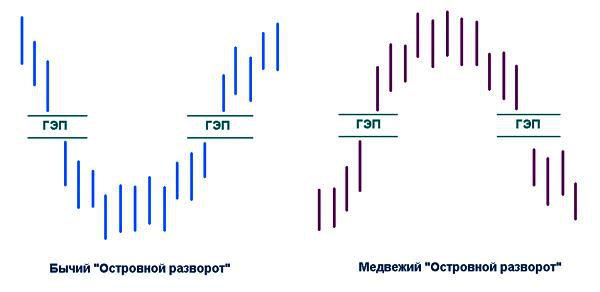

Pattern Island reversal is a combination of patterns of technical analysis Forex, which gives two coordinated signal:

- Exhaustion gap in the market where for a long time, there is a trend (bullish or bearish), indicates a gradual loss of strength until dominant players.

- Gap breakout confirmed signal of reversal and shows that the market begins a new trend.

Thus, the gap itself is a good indicator of the figures Forex. It can be used as a separate indicator, but it is safer to use other features, confirming the initial assumption.

Peculiarities of the pattern of Island reversal

Technical patterns Forex almost always apply subject to certain conditions. These conditions are additional characteristics that may potentiate the effect of the pattern or, conversely, to weaken it:

- Gaps exhaustion and breakdown are formed approximately on the same level.

- A bullish market is more reliable wide models, and to bear a narrow (with a little hesitation the price).

- Most often the pattern used in the stock market and indexes, where you can see the volumes. The more formed the volume during the formation of the gap of the exhaustion and especially the breakdown, the more reliable the signal.

- To select the timeframe is no single rule. Theoretically, these shapes of Forex market can be formed at any interval. However, it triggered a General rule: the higher the timeframe, the more reliable the signal. Moreover, it is important to note that a bearish reversal on a smaller interval may be part of bullish on the older and Vice versa. Priority is given to the eldest.

- To use the model during the release of important economic news is not recommended because the price can do some big jumps and gaps in different directions. It often gives false signals to enter.

- The effect of the pattern is enhanced if it formed along with the other candlesticks in Forex that also predict a reversal (for example, double top). You can use indicators trend change.

- The signal is more reliable if the gap breakdown occurs near to important trading support level or resistance, which has shown its strength in the past.

- Graphic figures of Forex do not always have the perfect view. For example, gap exhaustion can be quite small. However, the gap of the break is always a tangible difference.

Illustrative conditions:

How to apply pattern an Island reversal in the trade

To use Island reversal in real trading, it is important to learn how to identify it on the chart, and take into account the rules for determining stop loss and take profit:

- The entrance is just after the price has reversed and formed gap breakdown.

- Stop loss is set at the near the entrance a local maximum (minimum).

- Profit is taken when passing the distance equal to the movement from high island to gap breakdown (point of entry).

Application of the model in practice is most effective on level time frames H4 and above. Despite the fact that these cases have much longer to wait for its formation, the results are worth it, because to find the big trend at the very beginning of its formation means to do significant profit.