Pattern 5 0, as well as other graphic figures Forex is very popular among currency speculators and investors. The main reason for this popularity is the ease and General availability of these analytical tools. Setup 5.0. was developed in 2005 and its author is the well-known trader Scott Roots.

Forex technical analysis offers traders a huge variety of Analytics tools, the vast majority of which (pieces of the Forex market) are derived from the graphical analysis was developed (or rather, identified) based on years of observation and research charts, in which was revealed the pieces and the key regularities of their formation.

The indicator Pattern 5 0, though, and refers to the number of technical indicators in the Forex market, is this list a special place. Technical patterns Forex pattern and 5.0. have one, but very significant difference in the basis of harmonic pattern 5.0. lies a powerful mathematical Foundation. In fact, this pattern is a clear example of the practical application of Fibonacci levels. Not only that, but the simplest and most obvious.

Features pattern 5.0

As mentioned above, pattern 5.0. is one of the easiest (if not the most comprehensible) visual demonstration of how to use Fibonacci levels in Forex trading.

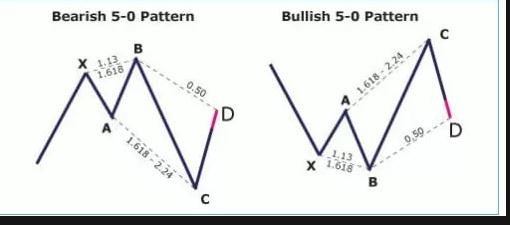

The shape starts with small movements of the market in the direction of a pre-existing trend (segment AB), which was preceded by a comparable depth correction (HA). Point is, it should not be above the level of the 161.8% of the point H. This is a fundamental point. If the point is In the “out” above, almost certainly a trader is dealing with a short-term correction and a continuation of the existing trend.

Segment BC, in relation to the segment AB, is formed in the range between 161.8% and 224%.

Segment CD represents a correction within the emerging trend. The depth of the correction (for classic algorithm of pattern) should be 50% of segment BC.

Trading strategy on the basis of Pattern 5.0

An indicator of patterns 5 0, which can be downloaded on any specialized Internet resource, contains at its core, mathematically reasoned statement according to which the segment AB is always equal to segment CD. Taking this statement for granted, and as practice shows, for good reason, you need to build on four points in a price channel. Trade in price channel, provided that the levels of support and resistance clearly defined, is a very simple task. The choice between shipovymi and limit orders depends solely on the ambitions of the trader and his desire to take the risk.

The following is a graphic interpretation of one of the most simple trading strategies based on pattern 5.0:

The advantages and disadvantages of pattern 5.0

Despite the popularity of this indicator and good “press,” which he collected to specialized information resources, I would like first to consider the shortcomings of the pattern. Chief among its shortcomings should be called bad “recognition” of shapes.

Developers and “popularizers” of the pattern, the emphasis on its universality. According to them, a pattern with the same efficiency operates on any instrument and on any time intervals. If the first part of this statement is undeniable, in respect of time frames, using the pattern raises many questions.

On short time frames this pattern is not effective because of high content of “white noise” and that does not allow clearly to “draw” the boundaries of the price corridor.

On large time intervals to create a corridor so wide that, in fact, can testify only about the direction of the trend (long-term). Thus, the efficiency of the use of this figure is highly dependent on correctly chosen time frame. It is not excluded criticism from apologists pattern 5.0., but more likely such a selection can only be done by accident.

In General, figure 5.0. to cope with the tasks provided in its functionality. However, each of these tasks can be solved using other indicators that may be harder to use, but generate more reliable signals.