The pattern of Three movements according to the method Linda Raschke is a harmonious pattern that are popular with traders in the Forex market very popular. The pattern of Three movements, and other graphic shapes Forex, is a model with a predictable development. Is a trend indicator which allows high accuracy to predict the direction of price movement of a trading instrument.

This indicator is a subject of many articles and other topical materials. In particular, the book is Linda Raschke street SMARTS discusses in detail the use and generation algorithms. The book also deals with the practical methods of using this indicator.

Three movements: detection methods

The candlesticks in Forex and their use as indicators of technical analysis are certainly the most discussed topic among traders and we can not say that all traders equally appreciate the analytical tools. The main theme of all discussions is the efficiency and accuracy of this figure in the Forex market. Candle patterns Forex in this respect is more specific, but their detection is often difficult.

The main condition for the effective use of graphic patterns is a correct choice of time interval. It should be noted that these indicators (most of them) should be used on medium-term (H4, D) and long-term charts. On short time frames these indicators generate too many false signals.

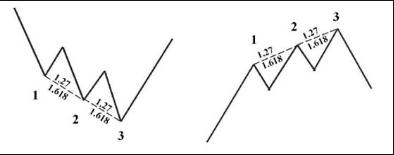

The gure shows the wave process. The undulating movement of the price is natural to all, without exception, trading instruments of the Forex market. To determine the pattern of Three movements, the following criteria:

- Price highs of the waves must be separated from each other on 0,618 is 0.78.;

- The distance between the adjacent lows of price waves (1;2, 2;3) is 1.27 or the 1.618 of Fibonacci;

- If the second and third cut patterns of equal length – it is safe to say that this is a classical pattern of Three movements.

Trade on the “Three movements”

Some authors strongly recommend to start the planning of the transaction after the completion of the first wave. But as practice shows, the first wave is very often short-term adjustments and at the end of the market continues to move according to the old trend. Speak confidently about the end of a trend and the turn of the market is possible only when the above conditions.

Perhaps the trader will be useful for a simple trading strategy, developed on the basis of the pattern of “Three movements”.

The algorithm of this trading system bullish trend includes the following steps:

- Installation order Bay Stop. For cautious traders are recommended to place the order at the level of 1,618. For the more adventurous suitable level of 1.27;

- Stop loss below the 1.618. actually rigid boundaries do not exist here. It all depends on the ambitions of the trader and his risk appetite;

- In the classic version of this system profit is recommended in three stages on the levels of 0.618, 1,27,1,618.

Like any, countertrend trading system, this strategy promises trader big profit and at the same time, the use of such methods is associated with a high degree of risk. It is natural, because in the process of turning the trend for the market is characterized by high volatility, the result of which is the generation of a large number of false signals. In such a difficult situation in the first place come the ability of a trader to properly manage assets and accurately to control their own emotions.

Advantages and disadvantages of a pattern “Three traffic”

Evaluating the pros and cons of the pattern, I should say that the Three movements is a typical reversal indicator with all the good and bad qualities inherent in this group of indicators graphical analysis. When properly installed and configured it is able to quickly and with a high degree of accuracy to assess the prevailing market trends and to warn about the desire of the market to change the trend. At the same time, as with all trend indicators, the Three movements are not able to determine the full potential of the market.