Japanese candlesticks in Forex long shot traders and more popular, because graphic shapes Forex have many advantages including leader visibility model.

The value of candlesticks in Forex varies greatly as to the thematic focus, and the significance (power) of the generated signal. In this article we will focus on the pattern of average power with a beautiful name doji Dragonfly – beautiful name Japanese candlestick patterns largely contribute to the growth of interest in these analytical tools.

Features candlestick patterns

The value of candles in Forex, i.e. the essence of their market depends on several factors:

- The geometric parameters of the body, and candles (absolute and relative);

- The combination of candlesticks in Forex which formed a pattern.

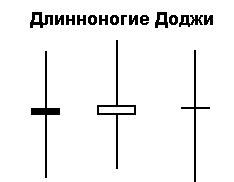

The second factor is especially important candlestick patterns, which are the doji candles. The candles in the Forex market is easily recognized on the chart. Short body (ideally, the opening price equal to the closing price) complete with disproportionately long shadows immediately attracted the attention of the trader.

Japanese candles for a Forex trader is informed about the unstable situation on the market. They are not self-sufficient and their signals require further confirmation.

Trade candlesticks Forex, despite its apparent simplicity, is fraught with many dangers, chief of which is the ambiguous trading signals generated by these patterns. Various types of candlesticks in Forex have varying degrees of reliability. Most of them is not considered by specialists as independent generators trade signals.

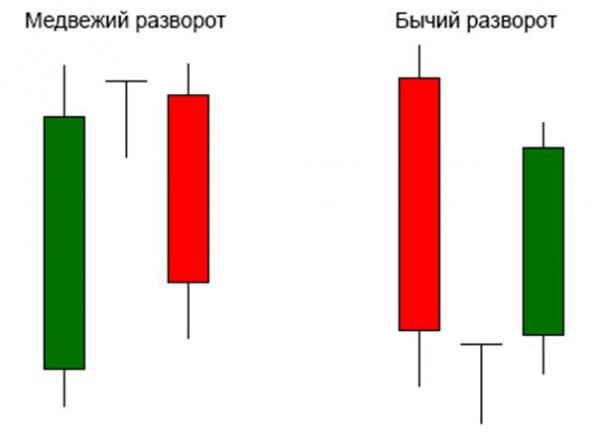

In this respect, the rotary models, which include Doji dragonfly deserve special attention. Their signals are not enough for decision-making, but their appearance on the chart is always (or almost always) is a harbinger of significant change in the mood of market operators.

Doji-dragonfly: nature of formation and peculiarities of the pattern

The dragonfly can be called one of the most recognizable figures of graphical analysis. Ideally, this is the candle which the opening price, closing, and maximum and minimum price goes back down. Of course, that ideal in real life is rare, therefore, the description of dragonflies can read is a white candle with a very short body, no upper shadow and a very long lower shadow.

The absence of the upper shadow is the defining moment. If the maximum price though the item rises above the opening price – the figure should be considered as a regular doji.

This model reflects the unsuccessful attempts of the existing trend to continue his winning streak. In most cases, a dragonfly heralds the reversal of the trend, and the opening price of the signal candle is a powerful support level.

In the absence of a pronounced trend to react to the formation of doji candles, including dragonflies, is not meaningful, i.e. a flat shape data have no meaning.

It is also important what the trend has formed pattern. On ascending figure is less informative – it often shows only a short-term correction, but to draw conclusions about the potential trend on its basis is impossible.

On a down-trend model, in most cases, warns that the “hegemony” of the bears comes to an end in the foreseeable future should wait for his turn.

Model with the same efficiency works on all trading instruments. The optimal time frame for this pattern is diurnal, although many reputable traders recommend the use of the Dragonfly and on the hourly charts.

Trade with a Dragonfly

As already mentioned, these technical patterns Forex, candle as doji is not able to generate trading signals. These patterns require confirmation by other analytical tools. In particular, after the model is generated in a downward trend, you must wait for the formation of white candles, and checking information by using the trend indicator to make a deal.

Fans of trade in the corridor Japanese candlesticks in Forex can also be useful – the minimum and maximum price of these candles will serve as the walls of the corridor.