When a new trader enters upon the path of knowledge of stock trading, there is a natural desire to gain knowledge from those whose reputation exchange bison is confirmed by many years of successful operations in this field. In this series, the name of Joe Ross, though not covered with glory, Larry Williams, takes a worthy place. His global approach to the study of financial markets and strategy Hooks Ross became the subject of study of many professional punters.

Trade Ross Hooks: simplicity is the key to the success of

In attempts to find and decode the code price changes, traders have tried a lot of different strategies and their combinations. The work involved the experts of such areas which, at first glance, are not associated with speculators – for example, the quantum method developed by nuclear physicists. D. Ross argues that it is possible to successfully cope with the market mayhem on the basis of simple laws which are inherent in the market and will always appear, regardless of how many bidders will know about them (currency trading on Forex is no exception).

Hooks Ross represent a pattern, named for the resemblance of shape with the equipment of the climber. Initially, Ross had his strategy in the commodity markets, when the era of electronic trading, the Ross Hooks, with some improvements, appeared in the Arsenal of strategies of Forex trading.

The most significant, from the point of view of manifestation patterns for the application of the methods of Ross are the currency pairs with the Japanese yen (yen against US dollar, pound sterling and Euro).

Hooks Ross category strategies Price Action, characterized by ease of use (special sympathy enjoyed by beginners). Of course, without basic knowledge no Hooks will not help to stay in Forex market, so learning Forex is mandatory to learn the trading science (as no one comes to mind, to begin the conquest of the mountain tops, without proper training or at least briefing).

Trade the Ross Hooks – features and rules:

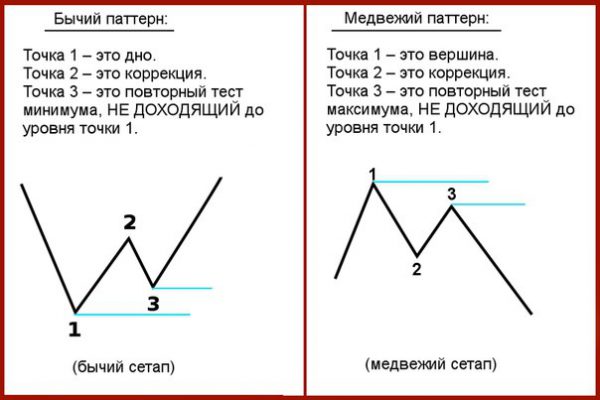

- A characteristic feature of the Ross Hook is the inability of the bearish (bullish) trend to reach another peak prices, followed by a correction.

- To apply this strategy, it is enough to have on hand a standard set of tools MT4 (and any other trading terminal).

- The strategy is applicable only in trending movements (Hooks Ross appear in the early stages of a trend).

- To see the Hooks Ross in a bullish trend, it is necessary to identify the preceding bearish trend (and Vice versa).

- The recommended ratio of stop loss and take profit is 1:2 or 1:3 (fixed).

- Open positions after the close of the 3rd candle sliding.

- Additional signals – stochastics, moving average, Bollinger bands, etc. (see Joe Ross – trading guide).

- Using the indicator Hook Ross you can simplify the task of finding the appropriate graphical models.

Identification of the pattern – the appearance point RH (Ross Hook), which is formed in the case of:

- price high updated point 2;

- in the correction, formed after the occurrence of the alleged peak of RH, the first 3 candles are below the line key price values.

Also the Ross Hook may be formed on the uptrend or downtrend after the formation of the pattern 1-2-3, which indicate the upcoming change of the main trend. What is this pattern: several successive local peak values (max or min) that form a zigzag structure on the price chart.

Conclusion: in this strategy, in the presence of the pattern can be open orders, no pattern need to stay out of the market.

Tips for traders from D. Ross

The decision to enter the market:

- no need to wait that a losing order that is about to unfold in the right direction and should be added to prove his innocence;

- to open a position, you need to determine the levels of stop-loss and profit based on the market situation and not on the basis of the size of a personal Deposit. If the stop, which must be set according to the strategic calculation is too large for the trader’s account, the opening of the transaction should be forgotten;

- the decision on the exit of the market should be based solely on the changed market circumstances.

The market has its own character:

- if exposed to high volatility, it is better not to get involved in the race for high profits;

- strategies bear market may not always be bullish;

- for each type of market (rising, falling, flat) need to have their “vending menu”;

- the canceled signal is a signal for the market (and Vice versa).

- to loss is always easier than income.

News impact:

- today’s news is best viewed tomorrow. News becomes irrelevant and does not prevent you to focus on your trading plan.

- if the market did not react to news instantaneously, so it can be important.

The time factor:

- the main tick of price movement is always the first and the last. It is necessary to open late, to go ahead;

- when the crowd is at full strength got in the deal, it’s time to leave the ship.

How to accompany the deal

- the volume must be constantly monitored. There should always be a plan B, in case of reduction in balance;

- do not confuse confidence with arrogance. If you’re having anxiety, you just have to close positions;

- success is evaluated only for a series of successful deals;

- the best way to stop the trade at a loss is to take a break and relax. The signal can be three deals with losses;

- if began a series of successful operations, it is not necessary to break the luck and stop trading.

To the recommendations of the master is to listen – despite its venerable age, D. Ross continues to actively and successfully trade on the stock exchanges, combining this work with teaching. Some tips are applicable not only to trading but to life.

For a detailed study of the peculiarities of the method Rossa, you can read a special literature, which is available for download – Joe Ross books about trading (with translation into Russian language): “Trade Hooks” and “Trade”.