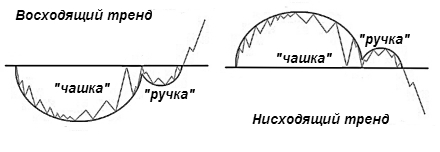

Cup with handle on Forex – bullish continuation pattern where the upward trend was halted and went down but will go up again at the end of the pattern.

Cup with handle, technical analysis which is relatively simple, is strong enough finished and works in most cases.

Pattern Cup with handle: description

Conventionally, this figure is divided into parts:

- the left wall;

- bottom;

- right wall;

- pen (you can also divide).

The figure of a Cup with handle is a fairly accurate harbinger of further price increase. The beginning of the formation contribute to the active sale. At the end of active sales the trend, mainly moves in the plane for a long period, without a clear trend. The next part of the pattern is directed upwards towards the top of the previous ascending movement. The final part of the picture, called a handle, is characterized by a relatively smaller downward movement, before the resumption of growth and a continuation of the previous trends.

The components of the pattern

To evaluate the potential trading signal we should define the components of the setup. It is worth noting that the larger the prior trend is, the lower the potential for a big breakthrough. The reason is that the main price movement occurred before the formation of the calyx, and the potential for upward motion is weak.

The figure of a Cup with handle Forex special, where design is very important: the form must be well-rounded like a semicircle. The reason is the following – pattern Cup with handle is a signal of price consolidation within a trend, where small speculators leave the market and new buyers and resolute investors remain on trend. The resulting angular shape of the bowl is not considered the true phase of price consolidation in an upward trend and thus the potential trading signal weakens.

The height of the bowl is also not left without attention: from the bottom to the top should be one third to two thirds of the size of the previous upward impulse, depending on previous volatility. Thus, if the prior trend was from 100 to 350 points, the depth of formation should be equal to the minimum value of 80 points (about 250 x 33%) to 160 (about 250 x 66%). The range from the edge to the bottom of the bowl is also used to determine the zero level and the establishment of the first objectives after the completion of the formation and breakdown of the handle.

Features handle

Another important component is the handle of the bowl, which indicates the completion of the combination and continuation of trend growth. As mentioned earlier, handle shows the downward movement, some correction after moving up on the right side of the Cup. The General rule of price movement down is that the amplitude of the handles can be repeated by one third of the growth achieved in the right side of the Cup.

During this downward movement to draw the local line of resistance, on which is formed the signal for a break. A move above this downtrend is a signal of what lies ahead, the expected recovery of the uptrend established from the outset.

A more conservative signal breakout (buy signal) is above the prices of the two peaks of the bowl. This is the price where the initial upward trend peaked and the point where the formation of Cup with handle has reached the maximum on the right side of the Cup before entering the pen. A break above this point is the strongest signal of the true resumption of the previous trend.

As with most chart patterns, volume is vital in the confirmation of the template and the generated signal. Again, the most important direction is the breakthrough: the greater the surge in prices on an upward breakout, the clearer the sign that the upward trend will continue. Here you can draw a parallel with the figure Head and shoulders, the price may return to the trendline to test the support again.

Under these rules it is possible to obtain a significant profit on Forex. Cup with handle is another time-tested pattern, due to which many traders earn. The conditions mentioned above are not absolutely true, but help to identify priority areas as input for the transaction.