In the Arsenal of the trader, there are different tools and strategies to trade. The most valuable of them can be considered as those which give the signal for the beginning of a trend change, that is talking about the emergence of new market trends at the stage of its inception. Graphical analysis offers several such models, for example – the Closing Price Reversal pattern. Literally it translates as “turn to close”.

On the chart it is defined is quite simple and almost always speaks of the cessation of both upward and downward trend.

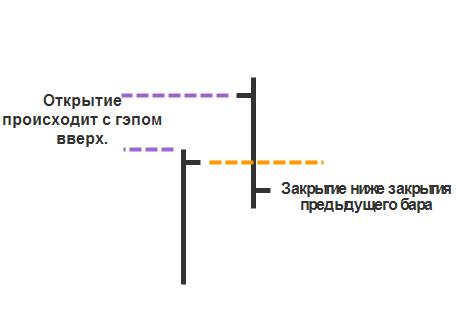

The emergence of bearish trend

In the first case the model is characterized by such features:

- newly bar is bearish, and its opening occurs with a gap (much higher than the previous close);

- this bar closes below the close of the previous candle.

It looks like this:

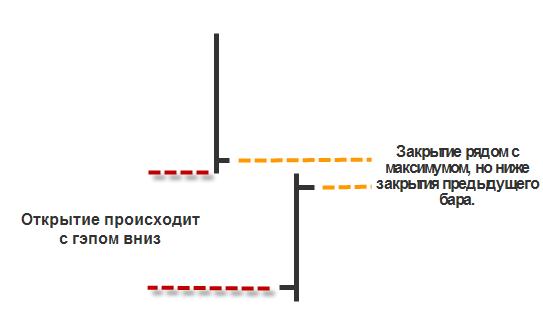

The emergence of a bullish trend

When the downtrend changes to uptrend, the pattern of CPR looks exactly the opposite:

- bullish bar on the right, opens with a gap down;

- the closing of the bar below the close of the previous candle.

It’s fun! Often the setup occurs on the futures markets, at least – on the stock and very rarely on the Forex market. Among the days of the week, he is more likely to occur on Monday, especially if before the weekend came important economic news.

What to consider

It is important to know the following rules of application of the model:

- The pattern is visually can be found on any timeframe, however, effectively it works at intervals of not less N1 watch (better to watch on D1).

- Desirable to trade some time (several hours) before and after the appearance of important economic news – the setup of CPR, like many others, may be false.

- Stop loss is better to put outside the high of the first bar in the sale (with minimum purchase).

Important! Strategies Price Action CPR is one of the most rarely occurring and at the same time requiring compliance with all the conditions. If the online chart still had a chance to see it, you can consider this luck, since the force of movement of the price is also quite large – as a rule, the price runs about 300 points.

The figure refers to a whole class of models, the name of which – patterns dual-use. Its name they received because they can give a signal as to the reversal of the trend and its continuation, depending on subsequent signs. Most CPR says about the turn in the market, however, for reliability it is better to wait for more confirmation and only then enter the market.

The results

The pattern of CPR refers to the strategy the Price Action, which does not imply the use of indicators, but it is not an axiom. For example, there is a special indicator CPR, signaling the appearance of this figure on the chart. You can also combine the reading of graphics with the use of other indicators – nothing is forbidden and every trades as it sees fit. Important is the result.