Candlestick analysis Forex gained popularity among traders in financial and stock markets. But in fairness it should be noted that customer loyalty candlestick analysis in the Forex market should “be grateful” the rapid development of computer and information technologies that have made stock trading available to the public.

Graphical analysis Forex, a variation of which is candlestick analysis the Forex attracts the attention of the clarity and apparent simplicity. Books on candlestick analysis in the Forex market, in any case, many of them diligently to popularize this dangerous delusion, trying to display candlestick patterns as some kind of panacea.

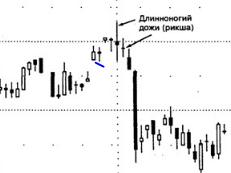

Features of chart analysis and a long-Legged Doji

Analytics for Forex is a complex procedure and only clear, their implementation is able to provide successful trade. To obtain objective and relevant information about the market, the trader must use as wide a range of analytical tools.

In this set are figures of technical analysis on Forex candlestick patterns mainly perform analytical role. For example, the candle long-Legged Doji enables technical analysis of the Forex market in real time, informing traders about the market is in a state of uncertainty.

If there was a rating chart patterns on the criterion of clarity, long-Legged Doji deservedly would have served in this leadership position.

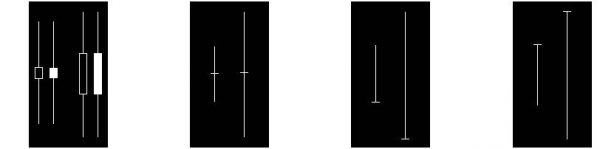

Patterns Doji (all kinds) are easily recognized on the market. This is a model with short bodies (ideally, the opening price Doji is equal to the closing price) and long shadows. The direction of shadows and their relative geometric parameters are of secondary importance. To the category are Doji candle in which the total length of shadows at least 5 times the length of the body.

Trade at the long-Legged Doji

As already mentioned, the “disembodied” patterns with long shadows symbolize the state of uncertainty in the market. But, to make any predictions on the base of this pattern, relying only on candlestick analysis Forex is impossible. Though Doji and belongs to the category odnoosnykh models – in this role they do not carry enough information.

Obviously, watching this figure on the chart it is easy to conclude that during the considered time period, the market was a serious struggle between bulls and bears. The length of the shadows in this situation allows you to judge the seriousness of the efforts of both parties – but this is all the information you can obtain from this model. With equal probability after formation of long legged doji, the market can turn, to continue moving in the direction of existing trend or to move in the horizontal direction.

For a more detailed analysis of this model should be considered in conjunction with the neighbouring candles.

But in this situation, “long-legged” pattern is not an independent generator of trading signals. In fact, the doji candle on the chart is just a “yellow traffic light”, which encourages the trader to prepare.

Thus, to speak of a clear trading system on the basis of long-legged patterns is not necessary. With a very strong desire this pattern can be seen as a price range. If the graph sequentially formed several such patterns, we can with high probability to say that there are no prevailing trends and price shopping tool “went East”. In this situation we can consider the minimum and maximum price leggy patterns as lines of support and resistance.

The results

The title “Trading strategy” in the above algorithm deserves a very big stretch. Not only that, the days of “anarchy” in the market is not the right time for profitable trading, and a graphical method calculate important price levels looks very doubtful.